Insights

The insights shared here reflect how institutional capital evaluates investments in practice. Topics span underwriting discipline, capital structure, risk mitigation, and incentive alignment, with each piece grounded in real transaction experience. Materials are designed to demonstrate how strategic thinking translates into investor-ready execution across the deal lifecycle.

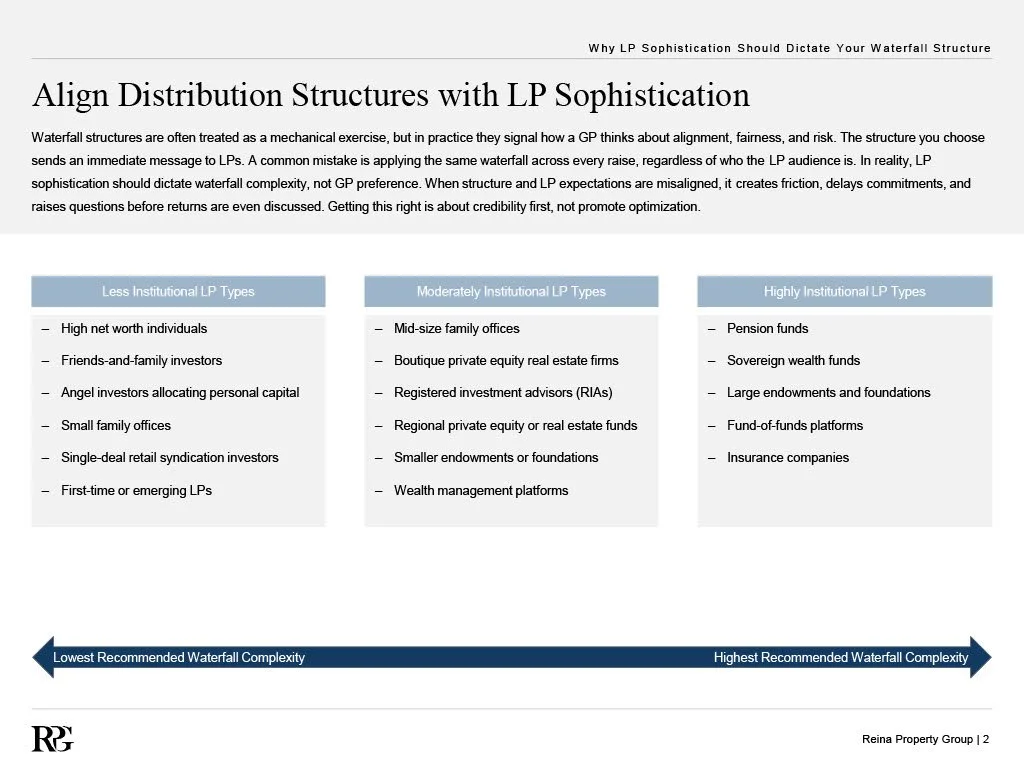

Why LP Sophistication Should Dictate Your Waterfall Structure

Waterfall structures are often treated as mechanical exercises, but in practice they communicate how a sponsor thinks about alignment, fairness, and risk. The structure selected sends an immediate signal to LPs about sophistication, transparency, and credibility.

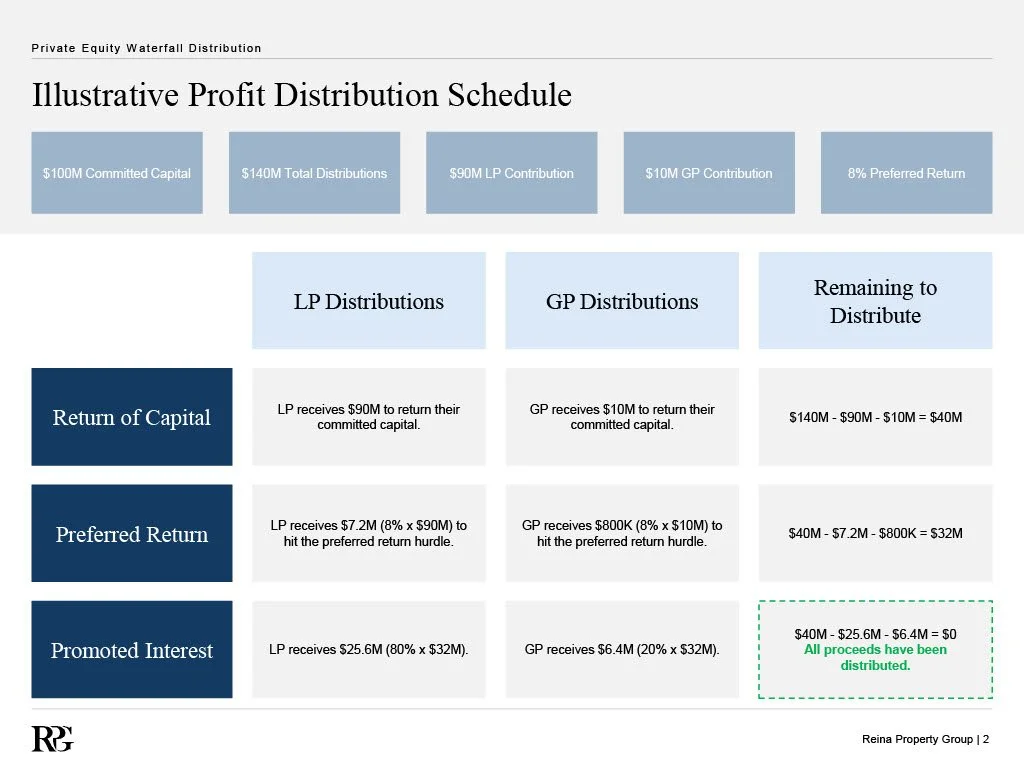

Pari Passu Private Equity Waterfall Distribution

The pari passu private equity waterfall distribution is one of the most commonly used, yet frequently misunderstood, economic structures in private market transactions. Under a pari passu framework, General Partners and Limited Partners participate proportionally in cash flows based on ownership, with no catch-up or promote during the initial stages of the distribution.

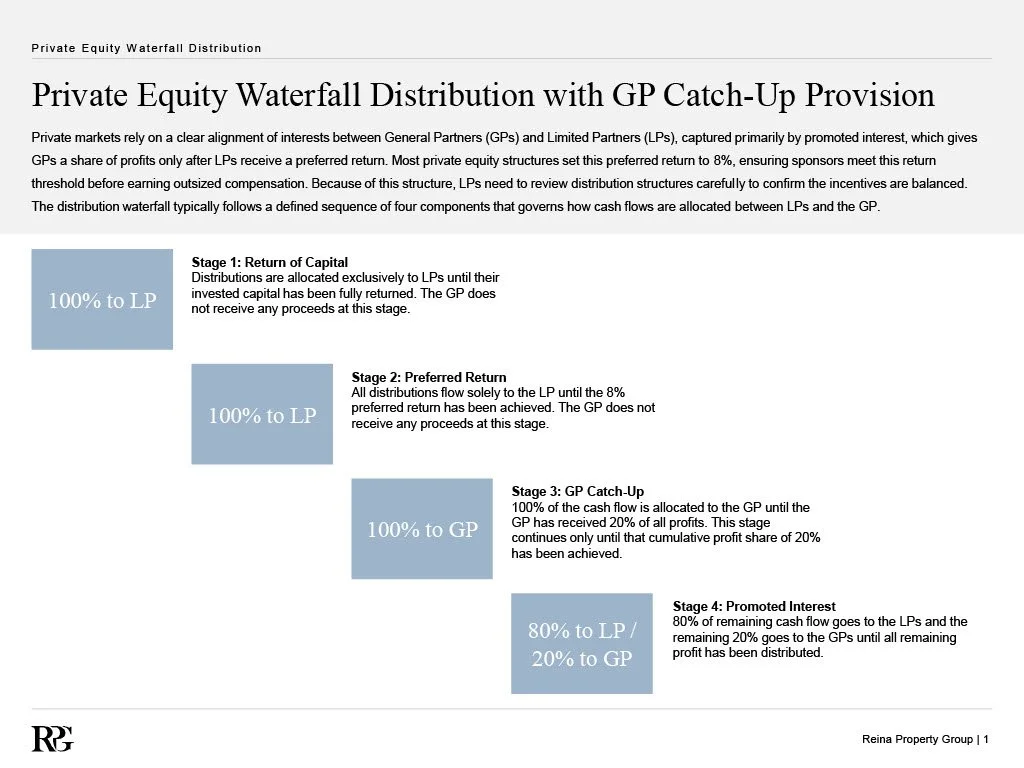

Private Equity Waterfall Distribution with GP Catch-Up Provision

One of the most common yet misunderstood components of private transactions is the waterfall distribution structure. Misunderstanding it leads to flawed waterfalls and misaligned incentives between the GP and LP; understanding it allows the GP to capture the value they create, maximize their promote, and convert strong execution into strong returns.